Sell put option calculator

An option to buy a stock at a certain cost is a call while an option to sell a stock at a certain price is a put. Learn More About American Funds Objective-Based Approach to Investing.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

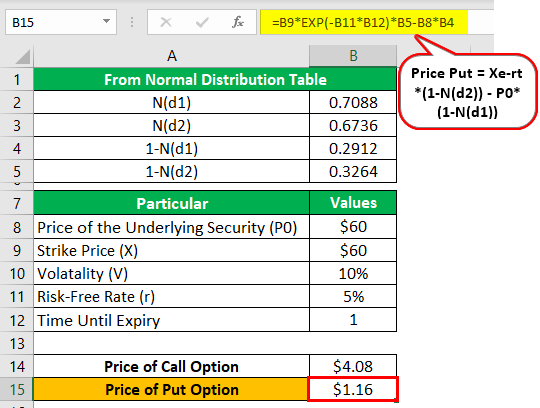

Option Pricing Models Formula Calculation

Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

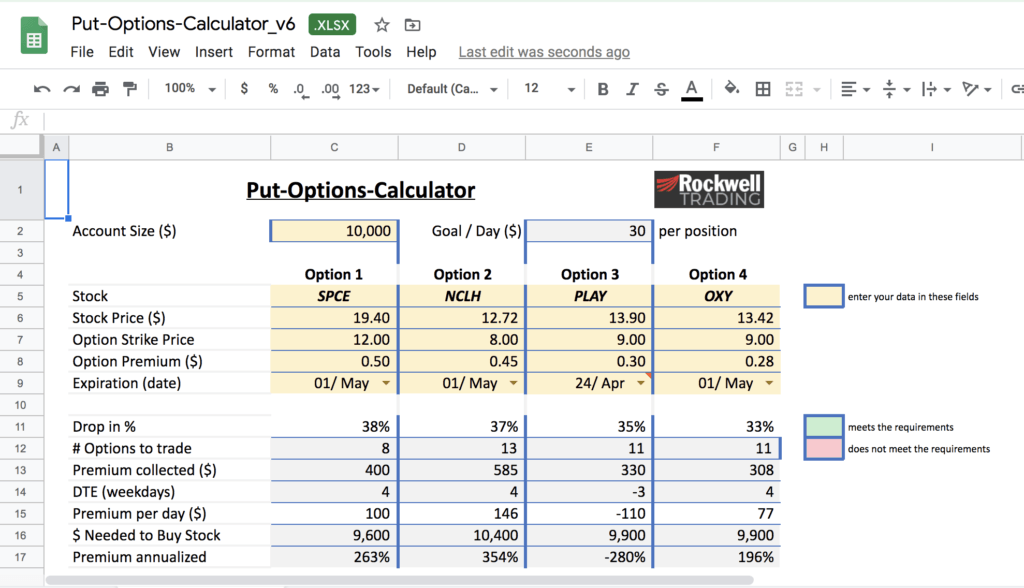

. Step one is to download the file using the button below. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. By selling put options you can.

You dont need a strong bull market or fast business growth for great. With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options. Clicking Add Stock will add the underlying stock to the.

Clicking on the chart icon on the Expensive Put Put screeners loads the calculator with a selected short put or short put. Copies of this document may be obtained from your broker from any. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Open an Account Now. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. If youre a put buyer use the Long Put tab and if youre a put seller use the.

This tool can be used by traders while trading index options Nifty options or stock. Generate double-digit income and returns even in a flat bearish or overvalued market. Open an Account Now.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option. Download The Option Profit Calculator. The strike price is 55 so you enter 5500 55 strike price 100 shares per option on the opposite.

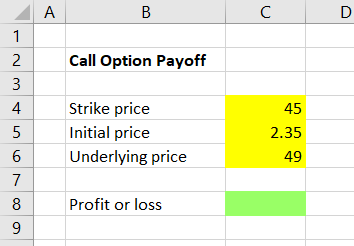

Options Profit Calculator provides an unique method to view the returns and. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. To find the maximum gain you have to exercise the option at the strike price.

This option premium calculator is able to swiftly calculate the rate of return for covered calls and cash-secured puts and also can determine the fair value of a stock. For example if ABC shares trade for 35 you could execute the put option that lets you sell. As long as ABC corp shares trade below 40 your put option would be considered in-the-money.

Options Calculator BROKERAGE MARGIN OPTIONS SPAN Check whether your Call or Put options are fairly priced Spot Price Strike Price Day To Expiry Interest Volatility DivYield.

Selling Put Options Tutorial Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

Selling Put Options Tutorial Examples

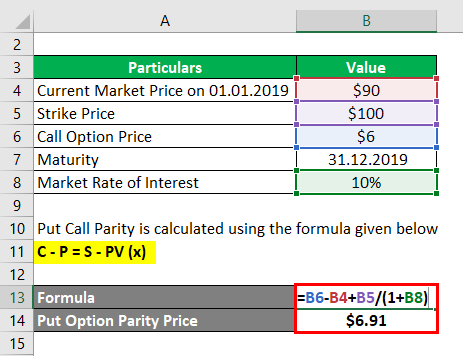

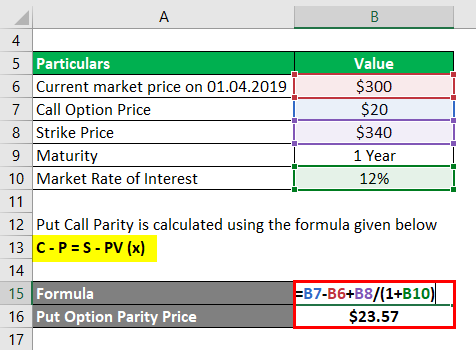

Put Call Parity Formula How To Calculate Put Call Parity

Summarizing Call Put Options Varsity By Zerodha

How And Why Interest Rates Affect Options

Theta Varsity By Zerodha

Stock Options Calculator Top Sellers 57 Off Www Ingeniovirtual Com

Short Selling Put Options

Call Option Calculator Put Option

Calculating Call And Put Option Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Put Call Parity Formula How To Calculate Put Call Parity

Summarizing Call Put Options Varsity By Zerodha

Put Call Parity Formula How To Calculate Put Call Parity